Money laundering risks in post-Soviet countries: what does the Basel AML Index reveal?

In 2019, the world saw a significant number of money laundering scandals related to “Russian money” entering the financial markets of European countries, revealed through investigations by the OCCRP and other investigative media outlets.

Consequently, the Basel AML Index has introduced a special geographic scope this year to provide an in-depth look at risks of ML/TF in post-Soviet countries. The Public Edition of the Basel AML Index covers the following: Armenia, Azerbaijan, Estonia, Georgia, Kazakhstan, Kyrgyzstan, Latvia, Lithuania, Moldova, Russia, Tajikistan, Ukraine, Uzbekistan.

Analysis of money laundering and terrorist financing (ML/TF) risks in the post-Soviet region shows that the average risk level is 5.4 out of 10, with significant deficiencies associated with corruption and bribery. In general, Central Asian countries (Kazakhstan, Kyrgyzstan, Uzbekistan, Tajikistan) have a higher risk of ML/TF in comparison to Baltic countries (Latvia, Lithuania, Estonia).

Basel AML Index risk scores since 2012

|

Country |

2012 |

2013 |

2014 |

2015 |

2016 |

2017 |

2018 |

2019 |

|---|---|---|---|---|---|---|---|---|

|

ARMENIA* |

5.13 |

4.9 |

4.86 |

4.89 |

4.63 |

4.44 |

5.23 |

5.11 |

|

AZERBAIJAN |

6.49 |

6.48 |

6.46 |

4.9 |

4.84 |

4.77 |

5.43 |

5.31 |

|

ESTONIA |

3.28 |

3.31 |

3.27 |

3.19 |

3.82 |

2.73 |

2.73 |

2.68 |

|

GEORGIA |

5.64 |

4.8 |

4.83 |

4.8 |

4.71 |

5.28 |

5.31 |

5.20 |

|

KAZAKHSTAN |

5.12 |

5.94 |

5.94 |

5.93 |

5.88 |

6.35 |

6.36 |

6.27 |

|

KYRGYZSTAN* |

6.31 |

6.36 |

6.29 |

6.27 |

6.21 |

6.24 |

6.19 |

5.86 |

|

LATVIA* |

5.36 |

4.93 |

5.03 |

4.98 |

4.91 |

3.64 |

3.98 |

4.89 |

|

LITHUANIA* |

3.96 |

3.81 |

3.64 |

3.67 |

3.62 |

3.67 |

3.12 |

3.55 |

|

MOLDOVA |

5.93 |

5.06 |

5.09 |

5.15 |

5.24 |

5.43 |

5.37 |

5.29 |

|

RUSSIA |

5.66 |

5.75 |

6.29 |

6.26 |

6.22 |

5.7 |

5.83 |

5.75 |

|

TAJIKISTAN* |

8.12 |

8.27 |

8.34 |

7.07 |

8.19 |

8.27 |

8.3 |

6.28 |

|

UKRAINE* |

6.62 |

6.47 |

6.55 |

6.56 |

6.57 |

6.45 |

6.06 |

6.01 |

|

UZBEKISTAN |

5.42 |

5.4 |

5.4 |

5.11 |

5.1 |

5.99 |

5.83 |

5.71 |

*Countries assessed with the 4th round FATF methodology

Small changes to the Basel AML Index methodology and indicators over the years, including the addition of a new indicator in 2019, may slightly influence results and comparability. However, it is clear that Central Asian countries (Kazakhstan, Kyrgyzstan, Uzbekistan, Tajikistan) have a higher risk of ML/TF in comparison to Baltic countries (Latvia, Lithuania, Estonia).

Quality of AML/CFT frameworks

Almost half of the countries (6 out of 13) were assessed with the FATF fourth round methodology in the last few years by the regional FATF bodies. The results of these assessments indicate that these countries have a medium level of risk related to ML/TF.

|

Country |

Effectiveness |

Technical compliance |

|---|---|---|

|

Armenia |

45% |

80% |

|

Kyrgyzstan |

27% |

54% |

|

Latvia |

30% |

63% |

|

Lithuania |

36% |

68% |

|

Tajikistan |

36% |

60% |

|

Ukraine |

36% |

69% |

Of these, Kyrgyzstan (27%) and Latvia (30%) demonstrate the lowest level of effectiveness. Armenia has the best performance in both technical compliance and effectiveness.

While risks identified by the FATF data for the region remain medium, more than 60% of the countries in the region, namely Armenia, Azerbaijan, Georgia, Kazakhstan, the Russian Federation, Tajikistan, Ukraine and Uzbekistan, are included in the US INCSR list of Jurisdictions of Primary Concern for money laundering.

According to the 2019 US INCSR report, for all of these countries the primary sources of illicit proceeds include corruption, fraud, trafficking in drugs, arms, and organised crime, prostitution, cybercrime and tax evasion. Money is often laundered through real estate, insurance, financial and non-financial institutions, shell companies and bulk cash smuggling schemes.

Countries in the US INCSR list of Jurisdictions of Primary Concern have produced relatively few criminal convictions pertaining to money laundering, which is a reflection of broad weaknesses surrounding the rule of law and judicial independence.

Financial secrecy

Another indicator to assess the quality of the AML/CFT framework of the region is the Financial Secrecy Index. Countries from this region are not present in the FSI’s list of top 25 financial secrecy jurisdictions. Russia holds position number 29 and Ukraine number 43, while Latvia holds position number 55 out of 112 jurisdictions listed in total. In general, the region is not scored as having a high level of financial secrecy risks.

Corruption and bribery

Existing data on corruption and bribery indicate a high risk level in this area. According to Transparency International's Corruption Perceptions Index and related analysis, Turkmenistan earns the highest risk points in the region, followed by Uzbekistan and Tajikistan. The region is the second lowest scoring region in the Basel AML Index, ahead of Sub-Saharan Africa.

Other risk factors

The data on financial and public transparency as well as political and legal risks differ heavily across the region, with Latvia and Lithuania showing the best results and Central Asian countries demonstrating the lowest performance.

About the Basel AML Index

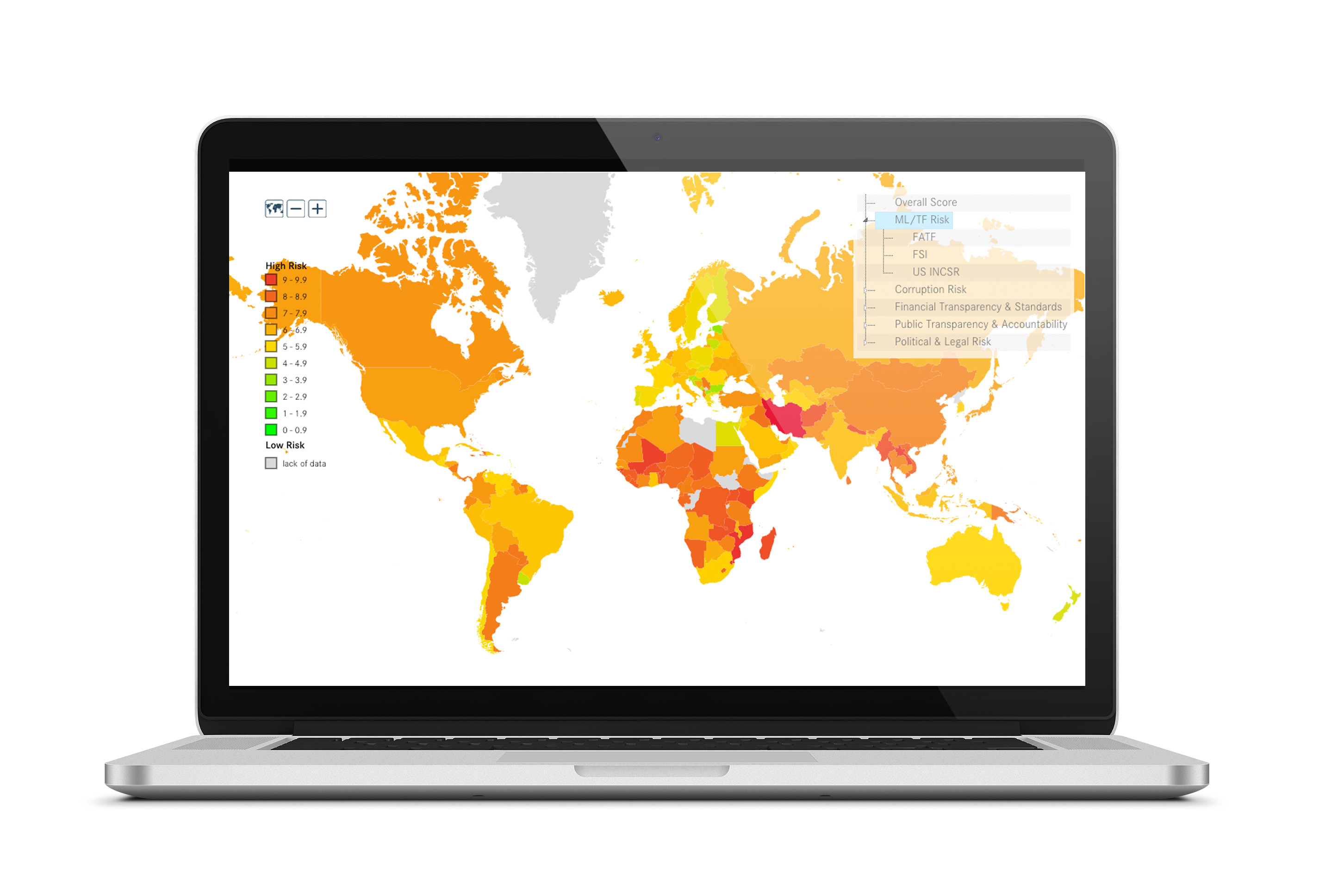

The Basel AML Index is an independent annual ranking that assesses the risk of money laundering and terrorist financing (ML/TF) around the world.

Published by the Basel Institute on Governance since 2012, it provides risk scores based on data from 15 publicly available sources such as the Financial Action Task Force (FATF), Transparency International, the World Bank and the World Economic Forum. The risk scores cover five domains:

- Quality of ML/TF Framework

- Bribery and Corruption

- Financial Transparency and Standards

- Public Transparency and Accountability

- Legal and Political Risks

The Public Edition of the Basel AML Index 2019 covers 125 countries with sufficient data to calculate a reliable ML/TF risk score.

A comprehensive list of scores and sub-indicators for 203 countries is available in the Expert Edition, a subscription-based service used by companies and financial institutions as an ML/TF country risk-rating tool for compliance and risk assessment purposes. Subscription is free for academic, public, supervisory and non-profit organisations.

Additional services and resources this year include an upgraded, in-depth analysis of FATF Mutual Evaluation Reports and a detailed analysis of ML/TF risks in particular regions, such as this analysis of post-Soviet countries.