What we’re changing in the Basel AML Index – and why

The 9th public edition of the Basel AML Index, an independent ranking of countries’ risk of money laundering and terrorist financing, will feature several changes to its underlying indicators and methodology. The new edition of the Basel AML Index is due to be released in early July.

The changes have been agreed by a group of external expert reviewers in the fields of AML, compliance and risk assessment. The group meets annually to review the Basel AML Index methodology in light of data availability and trends in global AML regulation and practice.

The new indicators and weighting adjustments reflect important evolutions in the sphere of anti-money laundering and counter terrorist financing (AML/CFT).

WEF data on judicial independence

The next edition of the Basel AML Index will include data from the Judicial Independence ranking of the World Economic Forum (WEF) Global Competitiveness Index as an indicator of Legal and Political Risks. The Judicial Independence data, which is published annually and covers around 70 percent of jurisdictions globally, will have a weighting of 5 percent of the total AML risk score.

Independence of the judiciary is key to the successful fight against financial crime. A politically dependent judiciary may lead to politically motivated prosecutions and/or give misleading information about the number of convictions for money laundering and terrorist financing (ML/TF).

A recent analysis of data from the Financial Action Task Force (FATF), prepared for Basel AML Index Expert Edition Plus subscribers, shows that countries with tight state control over the judiciary often score highly for the effectiveness of their AML/CFT measures. A good example is Russia, discussed in this article on Russia’s money laundering risks – what does the latest FATF report mean in practice?

From an AML perspective, close judicial control appears to be a positive element. On the other hand, it could also be a sign of limited political freedom.

TIP Report data on human trafficking

The second new indicator in the next edition of the Basel AML Index is the Trafficking in Persons (TIP) Report of the US Department of State, which ranks around 160 governments according to their perceived efforts to acknowledge and combat human trafficking. This data will be included in the category of Quality of AML/CFT Framework with a 5 percent weighting.

Human trafficking is said to be the third largest source of income for organised crime groups after drug and arms trafficking, generating an estimated USD 150 billion in profits each year. A 2018 FATF report refers to human trafficking as one of the fastest growing and most profitable forms of international crime affecting nearly every country in the world.

Although issues of human trafficking are already partially covered in the Basel AML Index by FATF country assessments, the decision to include a specific indicator for human trafficking reflects its fast-growing importance as a predicate offence for money laundering.

The TIP Report relies on perception-based data and the results are sometimes challenged by countries. The ranking also reflects perceived government action to combat the crime rather than the size of the country’s problem. This demonstrates the need for more global data on human trafficking, not just to support efforts to combat the crime but also the related money laundering.

Exclusion of data on regulation of securities exchanges

The WEF Global Competitiveness Index stopped providing data on the regulation of securities exchanges in 2018. Until now, this data has contributed just over 5 percent of the total Basel AML Index score in the category Financial Transparency and Standards.

Since there is no adequate alternative data source, this indicator will be excluded from the next edition onwards. The category of Financial Transparency and Standards is still sufficiently covered by data from the WEF Global Competitiveness Index on “Strength of auditing and reporting standards”, as well as the World Bank’s Extent of Corporate Transparency Index and IDA Resource Allocation Index.

Decrease in weight of US International Narcotics and Control Strategy Report

The US Department’s International Narcotics Control Strategy Report (US INCSR) is an annual publication that collates information about AML capabilities and vulnerabilities. Its Volume II contains a list of “major money laundering countries”, which previously accounted for 10 percent of the total Basel AML Index score.

In 2017, the INSCR narrowed its classification from three levels to only one. Some observers believe turns the report into a sanctioning instrument for the 81 listed countries, although the US INCSR itself rejects any claim that there are sanctioning motivations behind the list. Until now, the Basel AML Index has used a model to impute the missing data, but this is no longer an option due to the age of the model’s underlying data.

Despite these issues, the INSCR data remains significant for financial institutions. It will therefore remain an indicator in the next edition of the Basel AML Index, but its weight will decrease from 10 percent to 5 percent.

Quick background to the Basel AML Index

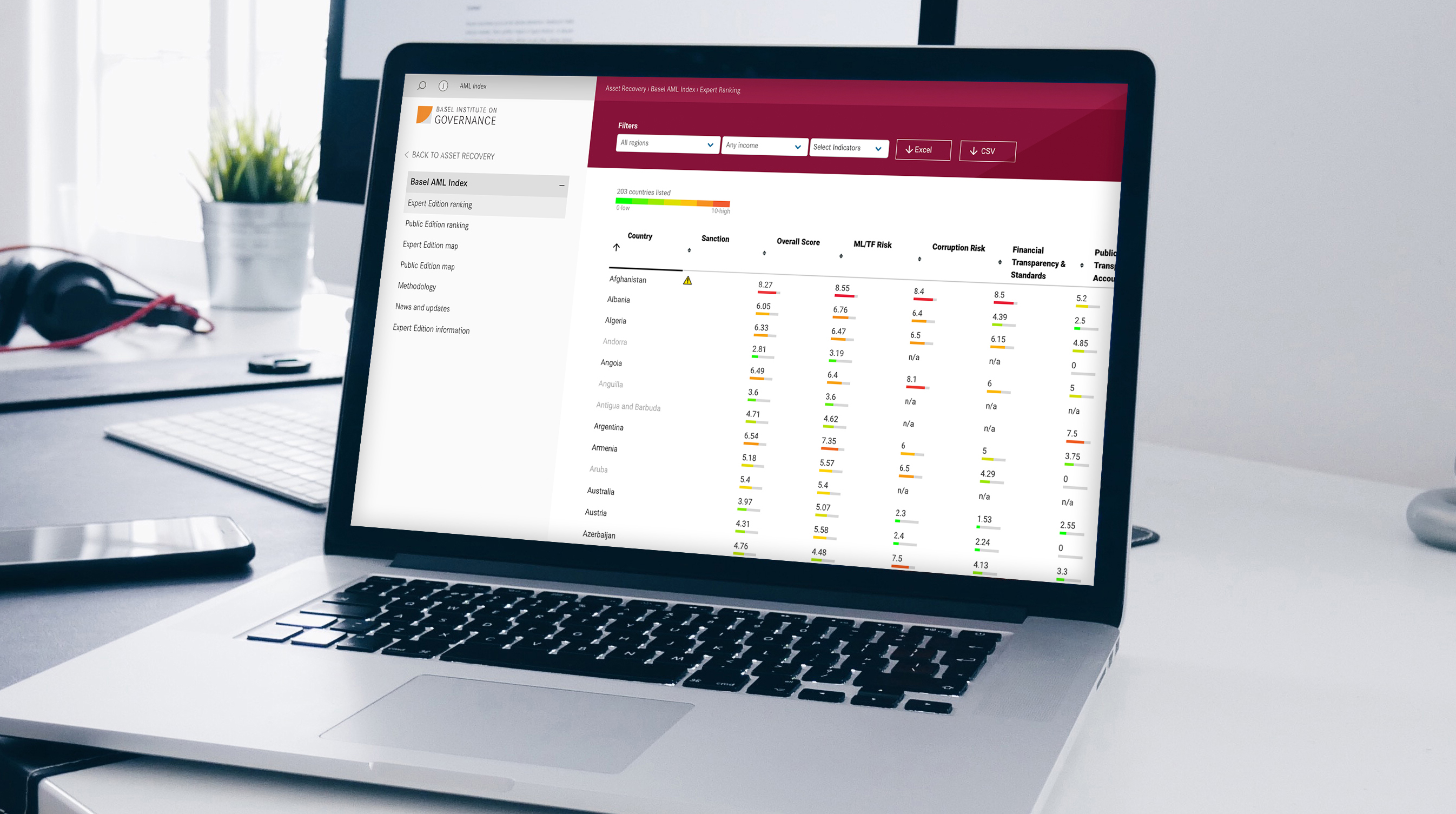

The Basel AML Index is an independent annual ranking that assesses the risk of money laundering and terrorist financing (ML/TF) around the world.

Published by the Basel Institute on Governance since 2012, it provides risk scores based on data from 15 publicly available sources such as the Financial Action Task Force (FATF), Transparency International, the World Bank and the World Economic Forum. The risk scores cover five domains:

- Quality of AML/CFT Framework

- Bribery and Corruption

- Financial Transparency and Standards

- Public Transparency and Accountability

- Legal and Political Risks

The Public Edition of the Basel AML Index 2019 covers 125 countries with sufficient data to calculate a reliable ML/TF risk score.

A comprehensive list of scores and sub-indicators for 203 countries is available in the Expert Edition. This is a subscription-based service used by companies and financial institutions as an ML/TF country risk-rating tool for compliance and risk assessment purposes. Subscription is free for academic, public, supervisory and non-profit organisations. The Expert Edition Plus option includes a detailed analysis of FATF data.