Blockchain and AML training for FinTech and compliance professionals

The Basel Institute on Governance has partnered with Zurich-based MME to offer a training course on blockchain, cryptocurrencies and anti-money laundering/countering the financing of terrorism (AML/CFT). The two-day course, FinTech AML Compliance Training, covers the essentials of blockchain and how to adapt AML/CFT processes to the FinTech industry.

Why is blockchain important?

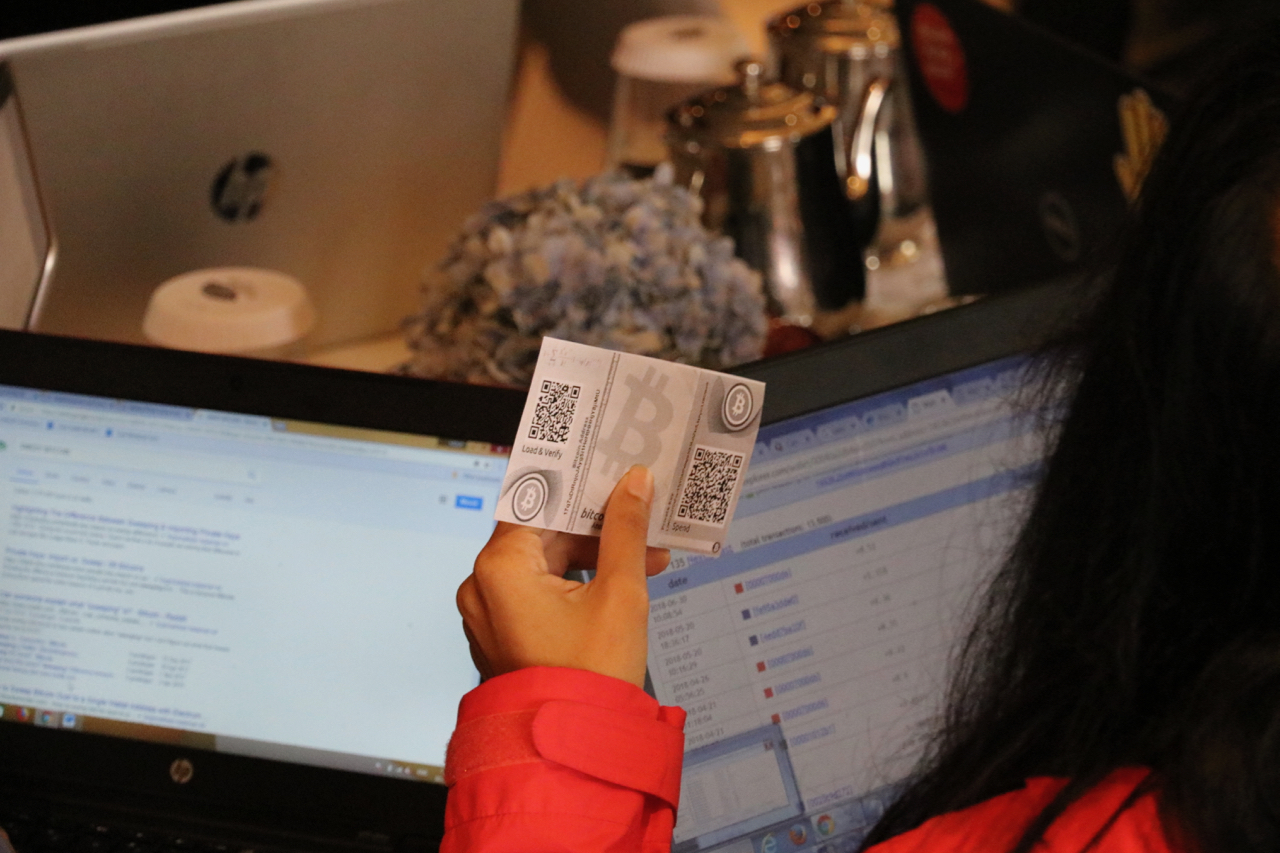

Money laundering and terrorist financing activities have become increasingly facilitated by cryptocurrencies. Based on blockchain technologies, cryptocurrency platforms provide criminals with new options for transferring funds peer-to-peer outside of sight and beyond the regulatory reach of authorities.

The aim of the course is to help FinTech, RegTech and compliance professionals detect and prevent the use of cryptocurrencies for illicit activities. The hands-on workshop involves practical cases and exercises. Participants will quickly gain the knowledge and tools needed to develop new AML/CFT policies and processes, or adapt existing ones, for the FinTech industry. The course is also suitable for other members of financial institutions and policy makers.

What does the course cover?

- Cryptocurrency and blockchain essentials

- Swiss and FATF recommendations applicable to cryptocurrencies

- Financial crime risks and prevention using blockchain analysis tools

- Key components of a FinTech AML program

Who are the trainers?

Chris Gschwend is a Senior Compliance Advisor at MME with 13 years of experience in implementing and auditing AML and trade compliance programmes in various industries.

Federico Paesano is a Senior Financial Investigation Specialist at the Basel Institute on Governance. As a Chief Investigator for the Italian Financial Police, Federico led financial investigations for 14 years, focusing on corruption and money laundering. As part of the training team of the Basel Institute’s International Centre for Asset Recovery (ICAR), he delivers regular training courses around the world to investigators, prosecutors and other professionals working to tackle money laundering and financial crime.

Course details

- Target audience: Financial institutions and FinTech / RegTech management, policy makers and compliance professionals

- Participants: 5 to 20

- Location: On-site at your location or in MME’s Zurich office

- Costs: Please contact us to discuss

- Format: Two day flexible course

- Certificate: Provided to participants present for the full duration of the training

Availability and dates

We offer courses on demand at MME's offices in Zurich or on the premises of individual companies.

How do I arrange a course?

Simply contact christine.gschwend@mme.ch for more information and to check specific dates.